目前非银行金融机构资产已达到全球金融资产的 50%,其重要性不言而喻。本期季报邀请欧洲央行前研究员撰文,针对非银金融机构的气候风险敞口、气候承诺和相关的法规进行分析点评。作者强调,非银机构在全球金融体系占据半壁江山,监管对其气候风险的监管和控制却严重滞后于银行,在一些研究警告非银机构也具有引发气候风险广泛传播潜力的情况下,作者提出需要从防范洗绿、建立标准等方面促进非银机构真正参与应对气候变化行动,防止发生变相的“公地悲剧”①。

Fake it till you green it: climate risk, commitments and regulation for non-banks

Régis Gourdel

威尼斯大学(Ca'Foscari University of Venice)研究员,维也纳经济学院(Vienna University of Economics and Business)在读博士,欧洲央行前研究员

1. Introduction

Non-banks have reached a critical size within the financial system globally. However, the efforts by regulators to contain their exposure to climate risk have been lagging, with less supervisory endeavor than for banks, sometimes forcing civil society to complement it. Meanwhile, some studies aimed in recent years at quantifying and stress testing the exposure of non-banks to climate risk, raising the alarm on the potential for shock propagation.This comes in a context where recent and ongoing efforts have been made by policymakers to signpost financial institutions most committed to supporting the low-carbon transition. The motivations for doing so fall broadly into the following categories:

● mitigating financial risk, which includes protecting investors and avoiding the build-up of climate risk with potentially systemic consequences;

● providing an informational guarantee to investors with non-pecuniary incentives, i.e. those who do not want their wealth to contribute to environmentally and socially harmful enterprises;

● supporting sustainable policies enacted by the legislator.

Given the necessity to leverage private finance to reach climate change mitigation goals, the breadth of greenwashing in the financial industry calls for regulatory action. For both financial intermediaries and firms in the real economy, greenwashing designates the practice of companies presenting and advertising themselves as more environmentally friendly than they are. In the case of financial institutions, this is motivated by the appeal it has for investors. Thus, this is a concern for regulatory authorities (e.g. Belloni et al., 2020; IOSCO, 2021), and for the public interest at large, in takingeffective steps toward climate change mitigation (Cuvelier, 2021; Sénécat et al., 2022). Moreover, from the financial stability perspective, while non-banks have set some targets the risk is still poorly assessed. I review below what climate risk looks like for non-banks and how it interacts with recent changes happening within the industry and from the regulators.

①变相的“公地悲剧”指的是,金融系统内的机构承诺未来实现投资组合净零排放的情况下,却不会在短期内限制化石燃料投资,此时气候政策只会促使资源拥有者加快开采相关资源,加速全球变暖。

2. Exposure of non-banks to climate shocks

Previously, Battiston et al. (2017) quantified the particularly strong exposure of investment and pension funds to climate-policy-relevant sectors. Further, Semieniuk et al. (2022) showed how these same institutions own a large share of assets at risk of becoming stranded, often as a result of specializations that correlate with climate risk factors (e.g. sector or geography). Zooming in on European investment funds, Amzallag (2022) finds that they significantly overweight high-carbon firms in their portfolios on aggregate, and the climate risk of the financial sector remains generally high.

In this context, Carlin et al. (2021) made the case for considering short-term climate shocks and provided an application for transition risk on equity prices. The work carried out in Gourdel and Sydow (2022) extends this stream of work with a short-term climate stress test of non-banks that covers both transition and physical risks.② It builds a framework for their stress testing in a short-term time frame, i.e. plausibly unfolding over a few weeks. Crucially, Gourdel and Sydow (2022) capture contagion on two layers. The first is that of funds’ cross-holdings, i.e. the shares of open-end funds that are held by other funds, whose value changes based on the balance sheet of the issuing fund. The second layer is the overlapping exposures to securities on the secondary market, whereby investment funds can be exposed to common shocks, but can also impact one another by influencing prices through sales and purchases. This model allows for market shocks, i.e. changes in the values of traded securities, as well as liquidity shocks coming from redemptions by investors.

Gourdel and Sydow (2022) leverage data sets covering climate-related variables for the real economy and investment funds balance sheets. The data provide a first-of-its-kind dual view of transition and physical climate risk exposures at the fund level, with a global sample of 23,216 investment funds. The ensuing analysis shows that the topology of the fund network plays an important role in climate shock propagation and that both contagion channels matter, although few funds present a high-risk profile on both dimensions. More precisely, climate risk seems unequally integrated, with transition risk strongly mitigated or exacerbated by the specialization strategies adopted, but very little dispersion in physical-risk profiles.

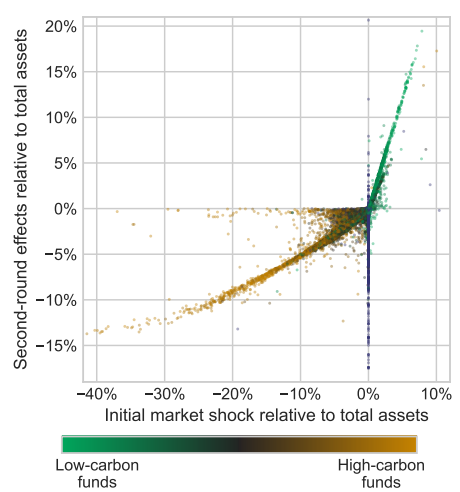

Figure 1: Scatter plot of results by investment funds for a

transition risk market shock.

The x-axis represents the initial shock incurred by investment funds, i.e. the gains or losses induced by changes in prices on the secondary market. The y-axis represents the sum of the following second-round effects, due to the revaluation of inter-fund holdings, flows from investors, and the consequences of fire sales triggered by liquidity stress. On both axes, the values used for each fund are normalized by their initial equity. For each fund, the color of the corresponding dot is determined by the weighted average of its portfolio carbon emissions, with low-carbon funds greener and high-carbon funds browner. A threshold is applied such that funds whose portfolios have too much missing carbon emission data are given a dark blue color. Several outliers are not represented in the chart.

Source: ECB/ESRB Project Team on climate risk monitoring (2022), based on Gourdel and Sydow (2022).

A stress test based on granular short-term transition shocks suggests that the differentiated integration of sustainability information by funds has made network amplification less likely, although first-round losses can be material. Figure 1 represents the effect at the fund level of a market shock driven by transition risk. The shock penalizes securities with high-carbon issuers and benefits those with low-carbon scores. Overall, “greener” funds display good results while “brown” funds can suffer consequent stress.

Second-round effects can be significant, and their most important driver is the flow-performance mechanism, i.e. the reaction of investors following first-round returns. Importantly, Gourdel and Sydow (2022) are the first to integrate the difference in flow-performance coefficients between funds with an environmental profile and others. That is, investors of “green” funds react less to losses but reward funds with larger inflows when they exhibit positive returns. This feature is calibrated from the literature. It explains that the slope on the top-right part of figure 1, where many low-carbon funds concentrate, is steeper than that of high-carbon funds in the bottom-left part of the chart.

Market shocks, such as those tested here, could have important consequences in terms of flows reallocated from high-carbon to low-carbon investment funds, although their timing is more likely to increase financial instability than allow useful investment in low-carbon sectors. On the other hand, there is room for fund managers and regulators to consider physical risk better and mitigate the second-round effects it induces, as they are less efficiently absorbed by investment funds. This is suggested by tests for both the integration by markets of physical risk information and by the materialization of extreme weather events. In both settings, funds exhibit a lack of differentiation, such that the impact is more uniform than for transition risk. Improving transparency and setting relevant industry standards in this context would help mitigate short-term financial stability risks.

②Transition risk is defined here as exposure to shocks induced by climate change mitigation, and physical risk is exposure to assets susceptible to destruction or valueloss from extreme weather events or evolving climate conditions.

3. Lagging and flimsy commitments

As climate risk gets more material and pressure mounts to support the transition, non-banks found ways to respond, either through actor-level strategies or by becoming members of networks dedicated to the issue. However, such actions still seem to fall short of aligning with global climate targets.

The Net Zero Asset Owner Alliance (NZAOA) is a case in point for how the industry, when left to its own device, lacks the will to decarbonize at the speed required.③ The NZAOA issued previously a clear call for the end of investment in thermal coal (NZAOA, 2020).④ Yet, its position on oil and gas (Peura et al., 2023) falls short of providing similar recommendations (Reclaim Finance, 2023b).⑤It claims to commit to “credible 1.5℃ net-zero scenarios” and cites compatibility with the IEA scenario net-zero 2050 and the One Earth Climate Model (OECM). However, IEA (2021) paths exclude new investments in new fossil fuel supply, and Teske et al. (2022) calls for an immediate cessation of private oil and gas projects to achieve 1.5℃ warming, based on the OECM. Thus, the NZAOA appears vague and non-committal relative to what the science directs.

When it comes to concerns for biodiversity, Peura et al. (2023) recommend a complete stop on financing only for environments such as the Arctic and deep water. The definition of a sensitive environment that motivates the recommendation is narrow, and it appears at odds with the social and environmental damages that new fossil fuel projects have at large.

③See Willis et al. (2023) for further description of greenwashing methods and related regulatory actions.

④There are caveats to it though, including the fact that it allows financing or insurance of projects that were in an early phase of construction in 2020, leaving open the possibility of stranded assets.

⑤ It is however more advanced than the Net Zero Asset Managers initiative, which is supported by the same institutional network, and lacks any kind of clear commitment concerning fossil fuel so far (The Net Zero Asset Managers initiative 2023). Similarly, the Paris Aligned Investment Initiative does not present commitments specific to fossil fuels investment (The Paris Aligned Investment Initiative 2021).

4.Shortcomings of market data providers

A common remedy to some of the previous shortcomings is the reliance on third-party data providers that can rate firms and portfolios. Let us zoom in on the information provision of environmental sustainability in particular, and set aside the broader issues of Environmental, Social, and Governance (ESG) ratings.⑥ While ESG ratings for non-banks are common, few options exist when it comes to climate-specific ratings at the level of financial products. When such ratings are available, they are generally based on ratings of firms in the real economy issued by the same data providers, and then fed into portfolio evaluations. Raghunandan and Rajgopal (2022) find that the funds that are designated “Low Carbon” do better environmentally than the ESG-focused ones or the funds that self-report as sustainable. Without negating the value added of third-party certifications, specific measurements and appraisals of firms on the “E” dimension are still not fully satisfying.

First, experts’ assessment of abatement efforts can be partial in scope and allow for greenwashing. For instance, Morningstar/Sustainalytics include forward-looking governance aspects such as the “firm’s ability to manage, and the quality of its management approach, to reduce carbon risks” in their assessment methodology (Hale, 2018). This may obfuscate the current environmental impact and result in firms such as Majid Al Futtaim receiving positive appraisals for the issuance of green bonds (Zakkai et al., 2019) while building ski resorts in Dubai and the desert of neighboring countries.⑦ This points to the fact that some modern projects may be environmentally low-intensity relative to the standard of a given sector, but still significantly harmful in the extensivity of their operations. Dubious green bond certifications add to the critics of ESG data providers, whereby some firms operating in the fossil fuel sector reached excellent ratings.⑧

Second, a low risk of stringent climate policies or environmental litigation is conflated with being green. This issue stems from another component of the scoring reported by Hale (2018): the “view on the degree to which the firm’s activities and products will be targeted for alignment with a low-carbon economy”. Thus, the rating appears to depend on what policies are likely to be enacted in certain countries, and not on the exposure to policies that should be globally applied to reduce carbon emissions. Cynically, a low transition risk exposure score would be justified in a country that signals non-commitment to climate mitigation targets.⑨ However, the method is more difficult to justify for Hale (2018) in that the criteria do not contribute to a transition risk exposure but rather serve to mark “low-carbon” portfolios.

This second point is a fundamental ambiguity of climate finance: mitigating transition risk includes but does not equate to greening the economy. In the above case, the methodology is marketed to investors that would care for the carbon footprint itself, and not solely seek to reduce their exposure to one type of risk. Thus, they would expect their investment opportunities to be assessed based on a fair metric and not one that would foster carbon offshoring. It is also of little value added for institutional investors who follow a science-based approach, such as portfolio alignment metrics.

5.Greenwashing and financial stability

Unfounded claims of environmental benevolence are most obviously clashing with the non-pecuniaryincentives of investors, as it negates their agency and ethical choices concerning their finances. The interaction of greenwashing practices with climate risk is however less clear, and it still constitutes a research gap. At the core, greenwashing constitutes an asymmetry of information between the provider and client of financial services, and one can identify several mechanisms through which it would worsen and amplify financial stress related to climate risk.

A prominent issue is the higher uncertainty on the greenness of real-economy firms and the portfolios they integrate. The danger of having a frail methodology is that climate policy shocks hit harder than expected, or that revaluations meant to better reflect the actual risk cause downgrades. Both scenarios would be compounded by large investor outflows. For ESG ratings and in the case of firms in the real economy, the current evidence for the impact of downgrades is mixed (Cauthorn et al., 2023; Berg, Heeb, et al., 2023). However, worries could exist for non-banks (S. Johnson, 2023). The rationale for a market reaction would be stronger for instance in the case of an investment fund downgraded that presented itself primarily as sustainable. Broader long-term effects could also be expected, as reevaluations could undermine the credibility of the scale altogether.

It also matters that financial risk is a dimension that is taken into account by investors and institutions already when it comes to sustainable investment. For instance, two green bonds would be seen as having common risk factors, and in general a correlation higher than between any two random securities. Therefore, for the manager of a portfolio with no sustainability specialization, hedging risk may command a limit in the share of green assets that the portfolio includes. Moreover, a discourse emerged around the possibility of a green- or ESG-bubble, although the evidence for it is mixed (Jourde and Stalla-Bourdillon, 2021; Aramonte and Zabai, 2021). This narrative is precisely based on the underlying assumption that assets categorized as low-carbon are perceived as homogeneous by market participants. This implies that crowding out may exist to an extent in green securities, so that greenwashed projects would access easier financing conditions at the expense of others fully dedicated to the low-carbon transition, such as renewable energy generation.

Lastly, the misallocation of sustainable finance capital can have a long-term effect as it leads to an underestimation of physical risk, with a false sense of mitigation. Meanwhile, physical risk adaptation can be a lengthy process that also requires early investment. Over-estimating the useful mitigation investment now may partially discourage adaptation investment, and thus lead to higher physical risk in the future.

6.Setting the conditions for regulatory progress

The core issue exposed above is the micro-macro inconsistency of climate finance as implemented so far, which is a variation of the tragedy of the commons. That is, institutions within networks will commit to reaching net zero for their portfolio, oftentimes referring to the 2050 deadline, but they will not constrain in the short term their investments in ways that would allow net-zero pathways to materialize. Battiston et al. (2021) emphasized the path dependency by which the reaction of the financial system is key in supporting the green transition, and how it may also impede its pursuit. For non-banks, the lack of ambition in the short-term would also preclude the achievement of their mid-century targets, because carbon-neutral portfolios will not be viable at scale then, in the absence of heavy and targeted investment in decarbonization now. These shortcomings are then increasing the pressure on policymakers to hold non-banks and financial institutions accountable for their sustainability claims.

Of late, regulatory efforts have focused on designing labels that would better indicate sustainability, and curb the greenwashing of misleading names. In the European Union (EU), this labeling is supported by recent regulations, such as the Corporate Sustainability Reporting Directive (CSDR), and the Sustainable Finance Disclosure Regulation (SFDR), which forces some transparency when sustainability claims are made. Moreover, some country-level initiatives have already emerged (Redon, et al. 2020),⑩ although not all have labels yet, with Ireland being a prominent exception.

Additionally, the European Ecolabel has recently been elaborated for the EU Commission (Dodd et al., 2020). It includes six criteria, including a cut-off on average portfolio greenness informed by the EU Taxonomy, and a near-total exclusion of fossil fuels. The Ecolabel appears ambitious in its current form, relative to pre-existing national labels, as only a handful of equity UCITS would currently qualify for it (Mazzacurati, 2022). Meanwhile, in the United States, the Securities and Exchange Commission (SEC) took initiatives to increase disclosure requirements and the control of non-banks with sustainability claims (Barton, 2022; K. Johnson and Kerber, 2022). The Chinese non-bank regulator plans similarly to reduce the leeway of investment funds in marketing themselves as green (Li and Shen, 2022), imposing lower bounds on the ratio of assets that should be categorized as sustainable.

A main research gap is the influence and appeal of the different labels, i.e. to what extent can the flows associated with labels incentivize non-banks to shift their portfolios? Indeed, the EU Ecolabel is based on absolute values and not relative to other funds (in contrast to the Morningstar label for instance). Therefore, if it affects investors then funds close to the threshold may adjust their portfolios to meet the criteria. So far, the development of labels seems to meet less opposition from the industry than proposals to prevent funds from unduly making sustainability claims through their names (see for instance EFAMA, 2023b). Not having a given label might be less of a disadvantage when a fund is still able to market itself as sustainable, for instance by still having the terms “green” or “transition” in its name. Thus, naming restrictions and higher litigation risk for greenwashing could be a pre-condition for the effectiveness of labels as a steering mechanism.

Another caveat lies in the dependence of policies on an underlying asset taxonomy, which might itself be flawed. Controversial categorization choices, such as possibilities for fossil fuel projects to qualify as “transition” tend to reinforce the uncertainty around the applicability, stability to future policy tightening, and the trust that labels would enjoy. This is currently a key point used by lobby groups of the asset management sector to contest new regulations (EFAMA, 2023a; EFAMA, 2023b). Thus, a stronger science-based direction and categorization are needed to better enforce regulations that contain both climate risk and greenwashing attempts.

Lastly, regulators have to work on the more difficult task of identifying the good forms of so-called stewardship or corporate engagement. The strategy relies primarily on dialogue and proxy voting, which is orthogonal to asset reallocation (Barnett and Peura, 2022). Recent regulations mostly capture the latter, so that PRI (2023) calls for a framework that recognizes stewardship. Non-banks and other financial institutions have reclaimed this tool (see e.g. Climate Action 100+, 2023), so the measure of its efficiency needs improving. This would also limit the possibility of greenwashing by non-banks that are so far avoiding asset reallocation to low-carbon sectors by simply claiming to adopt alternative strategies.

⑩This begs the question of a potential proliferation of carbon labels, where arguments can be made similar to the debate on labels for consumer goods (see e.g. Etzion 2022). While some are well-designed, national labels may complicate comparison and uniformization between countries.

参考文献 (可下滑查看)

本期百家灼见原载于北大国发院《气候政策与绿色金融》季报第四期。

本文版权为作者、北大国发院以及宏观与绿色金融实验室所有。侵权必究。