EXECUTIVE SUMMARY

The world needs more ambitious collective policy actions to reach net-zero emissions by 2050. The International Monetary Fund (IMF) proposes internationally coordinated carbon price floors – with levels adjusted to levels of development – as ideal climate mitigation instruments. In reality, the implementation of explicit carbon pricing systems at required levels and scale have been limited. Many countries, in particular developing countries, are opting instead for alternative non-explicit price measures and non-pricing regulations that work better within their economic, social and political contexts. Theoretical arguments have also strengthened the case for implementing a mix of pricing and non-pricing instruments.

This policy brief discusses a pragmatic way to foster international cooperation on climate mitigation by recognizing the contribution to carbon emission reduction of diverse policy measures, especially noting the preference of high greenhouse gas emitting developing countries for non-pricing measures. It draws on previous research from the Task Force on Climate, Development and the IMF, a consortium of experts primarily from the Global South utilizing empirical, rigorous research to advance a development-centered approach to climate at the IMF.

This research acknowledges that neglecting the impact of non-pricing measures is concerning to developing countries on two key fronts:

●Carbon Border Adjustment Mechanisms (CBAMs): Developing countries can experience negative spillover impacts on exports if CBAMs, such as the European Union’s, under-estimate the efforts of countries that use non-pricing climate instruments.

●Overestimating carbon pricing revenues: Assuming the widespread use of carbon pricing leads to the unrealistic expectation that it will provide the revenues to pay for the climate transition. This thinking, however, diminishes the need and urgency for international cooperation to raise climate financing, which is critical to support the climate transition in developing countries.

Against this background, this policy brief emphasizes the importance of facilitating global coordination of diverse climate mitigation actions, beyond explicit carbon pricing. This will be a complex task, both technically and politically, that will require effective consultations to reach shared understanding among countries. This brief, therefore, outlines four recommendations that the IMF and other policymakers should consider as they develop methodologies to assess the impact of non-pricing instruments to coordinate climate actions globally. These include

◆Providing policy advice that flexibly includes a mix of climate mitigation instruments to more effectively engage with policymakers.

◆Undertaking an inclusive consultative process among advanced and developing countries to develop a data base of key national climate mitigation measures and a better understanding of the impact of these measures on reducing carbon dioxide.

◆Developing widely accepted methodologies for countries to estimate the price-equivalent of these measures to advance discussions on ambitious and globally coordinated policies.

◆Raising the urgency for global cooperation to scale up climate financing to support the investments required for the climate transition.

Background

Mitigating climate change requires ambitious collective action among countries around the world. Through its working papers, the International Monetary Fund (IMF) has proposed an internationally coordinated carbon price floor (ICPF) as an ideal policy for international cooperation (Parry et al. 2021, Chateau et al. 2022a). Carbon pricing “promotes a broader range of behavioral responses for reducing CO2 emissions than non-pricing instruments.” While regarded as first-best policy in theory, however, the reality is that many countries are opting for other measures, including non-pricing interventions, that are easier to implement politically. Examples of non-explicit pricing policies include sectoral emission standards, fuel efficiency regulations, technology mandates, product bans and more. A recent assessment report by the Task Force on Climate, Development and the IMF proposes recognizing the contribution of diverse mitigation measures to reduce carbon dioxide emissions and developing widely accepted methodologies for countries to estimate the price-equivalent of these measures. These will not be easy to do – technically and politically – but will be pragmatic ways forward to foster international cooperation to achieve climate goals.

The Limits of “Explicit” Carbon Pricing Initiatives

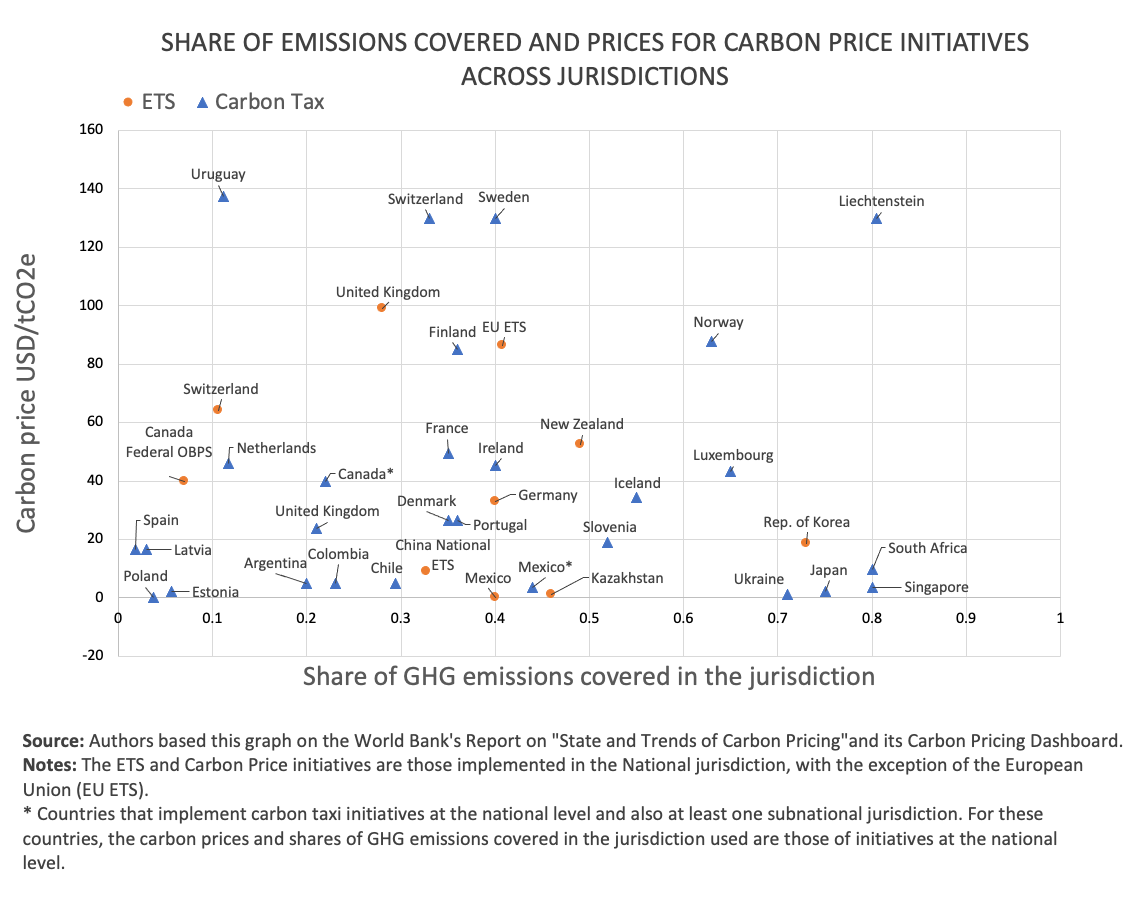

Explicit carbon pricing initiatives so far tend to have limited coverage and low prices (Parry et al. 2022). To date, the World Bank’s carbon price tracker reports that 35 advanced and developing countries have imposed national carbon taxes, and 25 have put in place carbon market trading systems (both considered as explicit carbon prices), both of which only cover about 20 percent of global emissions, and the explicit carbon prices in many countries are below US$20 per ton of CO2 equivalent (Figure 1).

Figure 1: Coverage of Explicit Carbon Pricing

A Preference for Non-pricing Regulations by Developing Countries

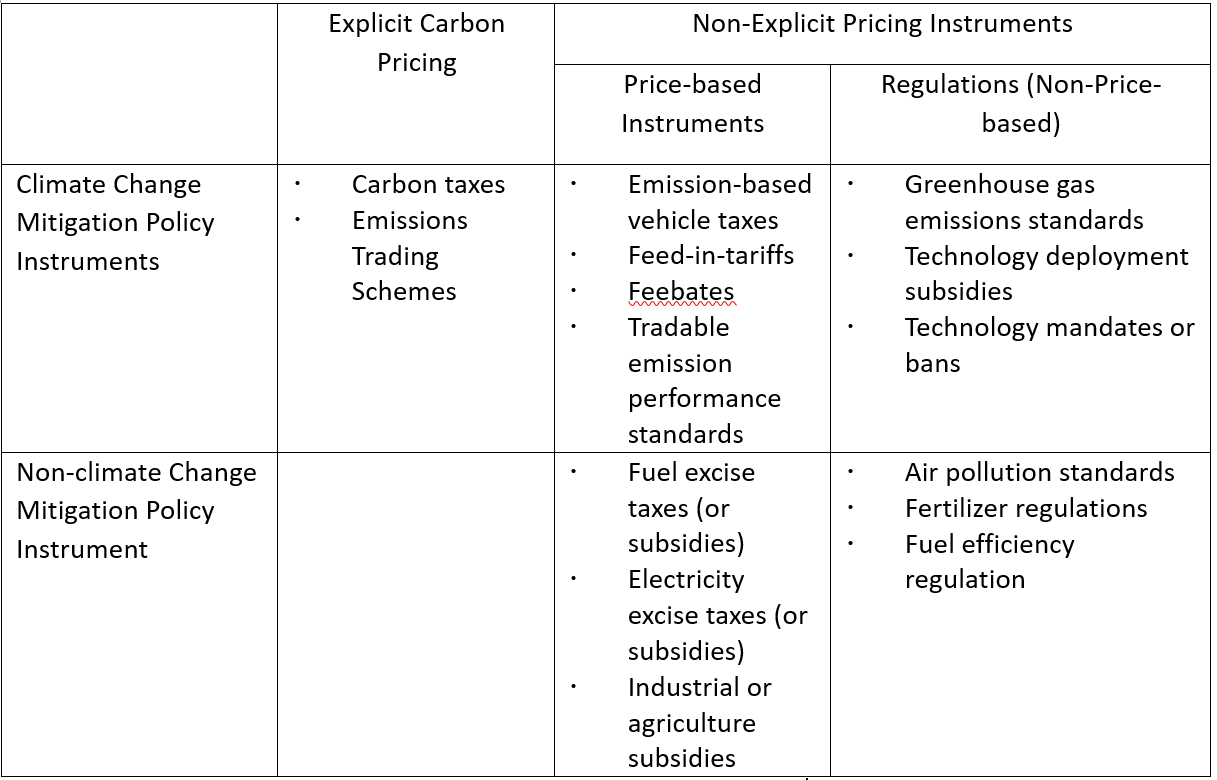

In practice, advanced and developing countries implement a combination of carbon pricing and non-explicit pricing measures to reduce carbon emissions (Table 1). The IMF’s Article IV consultations with high emitting developing countries suggest a preference for non-pricing regulations in key sectors because they are generally more politically acceptable than carbon taxes and carbon trading system (see also Ahluwalia and Patel 2022). One of the arguments often made against explicit carbon pricing is that rising energy prices hurt low-income households disproportionally, because low-income households spend a larger portion of their income on energy, which makes carbon pricing politically unattractive. Input papers for the G20 Sustainable Finance Working Group show the wide range of non-pricing tools that play a critical role in countries where typical pricing instruments are difficult to implement due to domestic political, institutional and social constraints (Asian Development Bank 2023; Kohli and Karoun 2023).

Table 1: Pricing and Non-Pricing Instruments

Source: IMF and Organisation for Economic Cooperation and Development (2022).

In the academic literature, the importance of non-pricing measures to address environmental concerns has been widely recognized. Finon (2019) shows that non-pricing instruments and polices, such as efficiency standards, market-oriented regulation and subsidies for clean technologies can deal with market and regulatory failures, which are more widespread in developing countries than in developed countries. The Stern and Stiglitz Report (2017) and Stiglitz (2019) recognize the importance of the second-best nature of economies and suggest that carbon prices may need to be complemented by other well-designed policies tackling various market and government failure. Stiglitz (2019) argues that carbon taxes are regressive and that distribution is the central reason for going beyond a single carbon price. He uses an analytical model to show that a more nuanced policy where carbon prices are supplemented by regulations and other non-pricing interventions can increase societal welfare, because regulations and other non-pricing interventions may reduce the general level of carbon prices to achieve a given reduction in emissions, therefore reducing the resulting adverse distribution. Recent empirical studies also demonstrate the reduction in pollution from regulatory measures in the United State and in China (Shapiro and Walker, 2018; Wang et al. 2021) and improved enforcement of environmental standards in India (Duflo et al. 2018). Cullenward and Victor (2020) further attribute the greater reliance on industry specific regulations rather than market based mechanism to reduce emissions to important political constraints that vary across sectors.

The Consequences of Not Recognizing Non-Pricing Instruments

Failure to recognize the role of non-pricing instruments has real spillover consequences on many developing countries. For example, recent research from the Task Force found that the European’s Carbon Border Adjustment Mechanism (CBAM), while aimed at preventing carbon leakage, could significantly affect exports of developing countries (He et al. 2022a) The CBAM ensures that an equivalent price is paid on the embedded carbon emissions of the imported product in the exporting country to, but this price underestimates the efforts made by many countries using non-pricing instruments to incentivize decarbonization. For example, China uses sectoral regulations to reduce carbon emissions, and India has an excise duty on petrol and diesel and other sectoral policies. Neglecting these efforts partly explains why the CBAM is viewed with concern by many developing countries.

Additionally, acknowledging the role of non-pricing instruments could open realistic opportunities for more coordinated policies globally. Additional Task Force research (He et al. 2022b) identifies a key problem with the IMF’s proposal of ICPF in that it implicitly assumes that carbon pricing is the only climate policy instrument adopted by each country. Broadly defined greenhouse gas mitigation measures that recognize diverse price and non-pricing instruments will generate more political buy-in, especially among developing countries. This will entail better understanding the impact of these measures on reducing emissions, estimating the price-equivalents of different mitigation policy instruments based on their impacts, and recalibrating the desirable floor prices to include observed carbon prices and the price-equivalent of non-pricing instruments.

Moreover, if carbon pricing is not the main tool used to motivate and finance low-carbon investments, and if it does not generate enough revenue to offset the decline in fossil fuel taxes, international cooperation to scale up climate financing is even more urgent. The Songwe, Stern and Bhattacharya (2022) report of the Independent High-Level Expert Panel on Climate Finance estimates a large financing gap between investments needed for the climate transition and the available development financing. Since revenues from national carbon prices will not fill this gap in the foreseeable future, global cooperation is critical to boost affordable external financing for climate transitions in developing countries.

Against this background, a positive development is the IMF’s recently softened stance on carbon pricing. In March 2022, the IMF Managing Director Kristalina Georgieva said, “…we recommend a steadily rising carbon price—including by equivalent non-pricing measures…to ensure a just transition across and within countries” (Georgieva 2022). IMF staff are moving in the direction of considering “equivalency” of carbon pricing and non-pricing instruments, as shown by an IMF working paper by Black et al. exploring methodologies to measure the “economy-wide price equivalent” for major countries, defined as the carbon prices that would yield the same emissions reduction as non-pricing policies. Yet another promising initiative going forward is the proposal by IMF and the Organisation for Economic Cooperation and Development (OECD) in their report for the G7 (2022) on a roadmap for data and analytical work to take stock of various mitigation instruments and develop methodologies to estimate and compare the impact of these policies on reducing emissions.

Developing Methodologies for Assessing Price Equivalence of Climate Mitigation Measures

Developing widely accepted methodologies for countries to assess price equivalence of climate mitigation measures will be a critically important input to advance the global discussions on ambitious and coordinated policies. Admittedly, the task is challenging on both technical and political fronts. As Kohli and Karun (2023) of the Center of Economic and Social Progress point out, most countries have multiple non-pricing measures that cut across sectors, and it is difficult to disentangle the contribution of each measure to emission reductions. The IMF/OECD report also emphasizes the key challenge of assessing the complex interactions amongst pricing and non-pricing tools. Therefore, the report largely abstracts from assessing the emission impact of individual non-pricing measures, and focuses instead on translating G20 countries’ announced sectoral targets to price equivalents by assuming countries implement policies sufficient to meet the declared targets. Under this approach, some important non-pricing measures may be omitted if countries do not make official announcements about sectoral targets. On the political front, to develop a methodological framework that is widely accepted by developed and developing economies will require better and shared understanding of country experiences in the use and effectiveness of diverse instruments. For example, in China, raising carbon prices in the trading market can face resistance from industries, but lowering the funding cost of green investments also results in relatively higher cost of carbon-intensive capital, thereby contributing to emission reductions. Efforts like this need to be recognized and accounted for by the “broadly defined carbon price” to address developing countries’ concerns of being placed at a disadvantage if a price-equivalent calculating framework is adopted.

Going forward, we recommend some steps to be taken by the IMF and multilateral forums to advance efforts to coordinate more ambitious, diversified climate mitigation measures across countries. One is to provide policy advice that flexibly includes a mix of climate mitigation instruments as a pragmatic way to gain traction with policy makers. Second is to undertake an inclusive consultative process among countries, with effective participation of developing countries, to take stock of key national mitigation measures. Third is to develop a widely accepted methodological framework to assess the impacts of these measures on reducing carbon dioxide and enable countries to translate them into price equivalents based on the extent of their emission impacts. And finally, raise the urgency for global cooperation to scale up climate financing to support the investment push required for the climate transition.

REFERENCES (Slippable view)

He Xiaobei is Deputy Director of the Macro and Green Finance Lab at the National School of Development, Peking University.

Marilou Uy is a Non- Resident Senior Fellow at the Boston University Global Development Policy Center and previously served as Director of the Secretariat of the Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development (G-24)