Najwa Abu Bakar

Senior Programme Director Sustainable Finance Institute Asia

1.0 Introduction

As the world’s fifth largest economic bloc, projected to be the fourth largest by 2030 (ASEANstats, January 2024), the Association of Southeast Asian Nations (ASEAN) is highly cognisant of the need to direct and orientate capital towards sustainable activities and investments whilst balancing the well-being of its citizens. The ASEAN region is vulnerable to climate change, including physical impact, the destruction of biodiversity and the ensuing catastrophic impact to citizens, businesses and governments. These include significant economic costs and physical damage, loss of human lives, assets and properties. At the same time, it is also critical to ensure that the pursuit of climate action does not cause economic and social dislocations, giving rise to the need for a just and orderly transition. A common language for sustainable finance that is inclusive for all the diverse ASEAN Member States (AMS) is an important enabler, and the ASEAN Finance Ministers and Central Bank Governors’ Meeting (AFMGM) endorsed the establishment of the ASEAN Taxonomy Board (ATB) in 2021 to develop, promote and maintain the multi-tiered ASEAN Taxonomy for Sustainable Finance (ASEAN Taxonomy), to not only suit ASEAN’s unique and diverse circumstances but also be interoperable with international taxonomies such as the European Union Taxonomy for Sustainable Activities (EU Taxonomy). The ASEAN Taxonomy is intended to be the inclusive, overarching guide that facilitates equivalence amongst AMS’ national taxonomies. Significant care was made to incorporate input from a wide range of stakeholders, including ASEAN government ministries and agencies, regulators, real economy participants and international organisations. The ASEAN Taxonomy is being developed through successive versions, with Version 3 published in March 204. At the AMS level, the release of Malaysia’s Climate Change Principle-based Taxonomy in April 2021 and the Sustainable and Responsible Investment Taxonomy in December 2022, Thailand Taxonomy Phase 1 in June 2023, Singapore-Asia Taxonomy in December 2023, Indonesia Taxonomy for Sustainable Finance and Philippine Sustainable Finance Taxonomy Guidelines in February 2024 have also provided support to the region’s sustainable finance ecosystem. ASEAN’s unique approach to sustainable finance taxonomies, incorporating the transition imperative, mirrors the common but differentiated approach reiterated by the First Global Stocktake of the Conference of Parties serving as the meeting of the Parties to the Paris Agreement released on 13 December 2023, which called for the rapid reduction in global emissions and to consider different national circumstances, pathways and approaches. One of the approaches recommended by the First Global Stocktake was transitioning away from fossil fuels in energy systems to achieve net zero by 2050, in keeping with the science. A robust framework that supports environmentally and socially responsible financial practices is one of the approaches to develop a sustainable finance ecosystem. This paper focuses on sustainable finance taxonomies.

2.0 Overview of Taxonomies

In orienting capital towards sustainable economic activities and climate action, a comprehensive classification system- a taxonomy- that serves as a credible guide to define what sustainable activities are, can help propel the allocation of finance. Over the past decade, an expansion of official and private taxonomies emerged and currently, more than 50 official taxonomies (national and regional) have been developed or are in development, with at least 150 significant proprietary taxonomies belonging to private sector entities in existence. This potentially brings the number of taxonomies related to sustainability to over 200 (E3G, February 2022). The early taxonomies included the Climate Bond Initiative’s Green Taxonomy (2013) which focused solely on climate change mitigation and was used for certification purposes and the China Green Bond Endorsed Projects Catalogue (2015) issued in 2015, that applied to green bond issuances by financial institutions in China. Additionally, the Multilateral Development Bank–IDFC Common Principles for Climate Mitigation Finance Tracking Version 2 was published in 2015. In 2018, the European Commission established the Technical Expert Group on Sustainable Finance to assist in developing the EU Taxonomy, which came into force in 2020.

Taxonomies are a part of the sustainable finance ecosystem and are not optimised on their own. ASEAN focuses on three ecosystem pillars – Taxonomy, Transition Finance Frameworks and Disclosures. Taxonomies provide a common language for identifying sustainable activities but their approach and assessment criteria may need to be tailored to address national priorities, including economic and socio-political circumstances.

3.0 Inception

The need for a common taxonomy for ASEAN was identified in 2020 in three key documents, the ASEAN Capital Markets Forum (ACMF)’s Roadmap for ASEAN Sustainable Capital Markets (2020), the ASEAN Senior Level Committee on Financial Integration (SLC)’s Report on The Roles of ASEAN Central Banks in Managing Climate and Environment-related Risks (2020) and the ASEAN Working Committee on Capital Market Development (WC-CMD)’s Report on Promoting Sustainable Finance in ASEAN (2020). Each report emphasised the need for a credible, consistent and interoperable taxonomy for ASEAN but contextualised to the region’s unique circumstances, comprising mostly emerging markets and developing economies. Without a common language, sustainable projects may be exposed to the risk of greenwashing and this in turn will hamper the facilitation of transition as well as discourage investments into sustainable projects. An ASEAN taxonomy can help harmonise the definitions for green and sustainable activities and projects across AMS but needs to consider AMS’ different starting points in economic development, socio-political structures, financial systems and resources. A regional taxonomy that considers all these peculiarities, and that is configured to support a transition journey would widen access among financial market participants to drive the region’s sustainability agenda.

4.0 Governance

The ATB was established with the mandate to develop, promote and maintain a multi-tiered taxonomy that takes into account the region’s needs, as well as international aspirations and goals and to facilitate an orderly and effective transition. It was established under the auspices of the AFMGM at its 7th Meeting in March 2021. Members of the ATB comprise the four ASEAN sectoral bodies that represent the banking, capital market and insurance sectors, namely the ACMF, SLC, WC-CMD and the ASEAN Insurance Regulators’ Meeting.

5.0 Design Overview

5.1 Design Principles

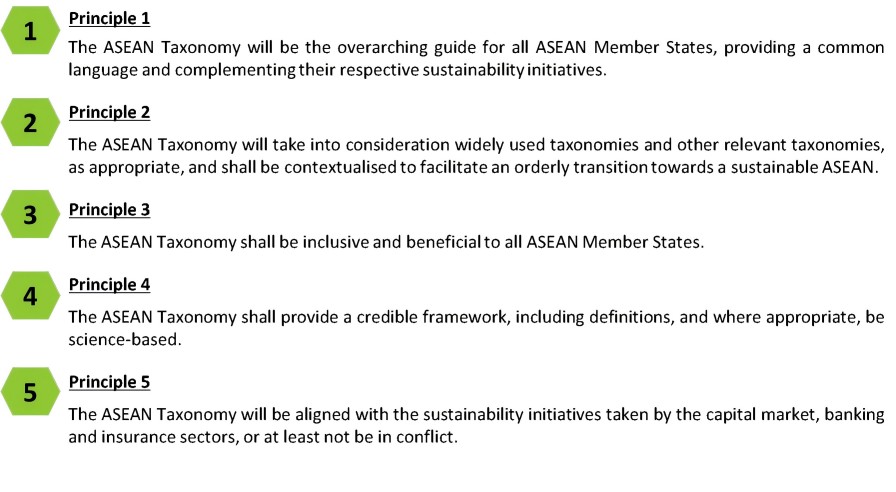

The ASEAN Taxonomy observes five high-level principles that are intended to cater to different stages of ASEAN economies, financial systems and transition paths:

Figure 1 - Principles for Developing and Implementing the ASEAN Taxonomy

Source: ASEAN Taxonomy Version 1

5.2 Rationale for a multi-tiered approach

A multi-tiered approach was deemed appropriate after ATB’s careful consideration of AMS’ challenges in technological and geographical limitations as well as structural economic and social challenges in deploying sustainability, in particular climate action solutions. Given these factors, the ATB conceived a ‘building blocks’ approach. At the assessment frame level, this involved providing a principles-based Foundation Framework (FF) and a Technical Screening Criteria (TSC)-based Plus Standard (PS), while at the TSC level, multiple tiers were incorporated.

The FF and PS are underpinned by ASEAN’s commitment to sustainability. The PS was designed with the goals of the Paris Agreement to limit the global average temperature increase to well below 2°C, preferably 1.5°C, above pre-industrial levels in mind, with the highest tiers in the PS reflecting the 1.5°C ambition.

Under both the FF and PS, economic activities must significantly contribute to at least one of the Environmental Objectives (EOs) and all Essential Criteria (EC) of the ASEAN Taxonomy. The PS provides quantitative and qualitative TSC at the economic activity-level, on the taxonomy eligibility of economic activities and investments based on Paris Agreement-aligned goals. The PS’s Green tier references the EU Taxonomy TSC and two Amber tiers are also incorporated to represent the transition imperative and cater for the different starting points of each AMS.

5.3 Key Features

The ASEAN Taxonomy is a taxonomy for sustainable finance. However, its current focus is on decarbonisation and specifically takes into consideration ASEAN’s transition needs. Other sustainability aspects will be added over time, taking into account ASEAN’s specific needs.

Figure 2 – Key Features of the ASEAN Taxonomy

Source: Sustainable Finance Institute Asia (2022)

5.4 EOs and EC

The ASEAN Taxonomy has also taken into consideration other widely referenced taxonomies, with augmentations to the ASEAN context where relevant, in developing its criteria. This is especially important to enable interoperability of the ASEAN Taxonomy and other internationally referenced taxonomies. The ASEAN Taxonomy’s four EOs of climate change mitigation, climate change adaptation, protection of healthy ecosystems and biodiversity and promoting resource resilience and transition to a circular economy, encapsulate all those covered by the EU Taxonomy. In addition, the ASEAN Taxonomy’s EC of Do No Significant Harm (DNSH), Social Aspects (SA) and the use of International Standard Industrial Classification (ISIC) are interoperable with the EU Taxonomy. A unique feature is the ASEAN Taxonomy’s Remedial Measures to Transition (RMT) EC, which has been incorporated to include the concept of remediation to facilitate transition. All EC must undergo assessment in both the FF and PS.

5.5 Focus and Enabling Sectors

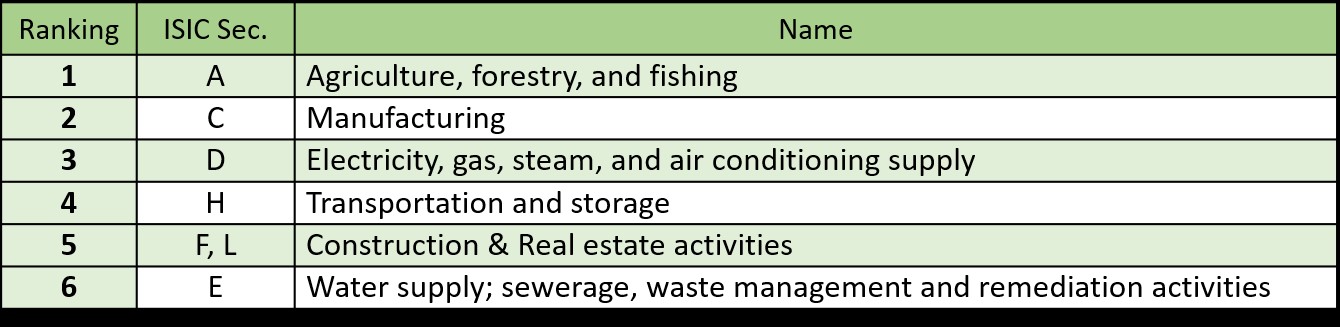

The PS focus sectors represent 85% of Greenhouse Gas Emissions and 55% of Gross Value Added in ASEAN:

Figure 3-1 – Focus Sectors in the ASEAN Taxonomy

Source: ASEAN Taxonomy Version 1

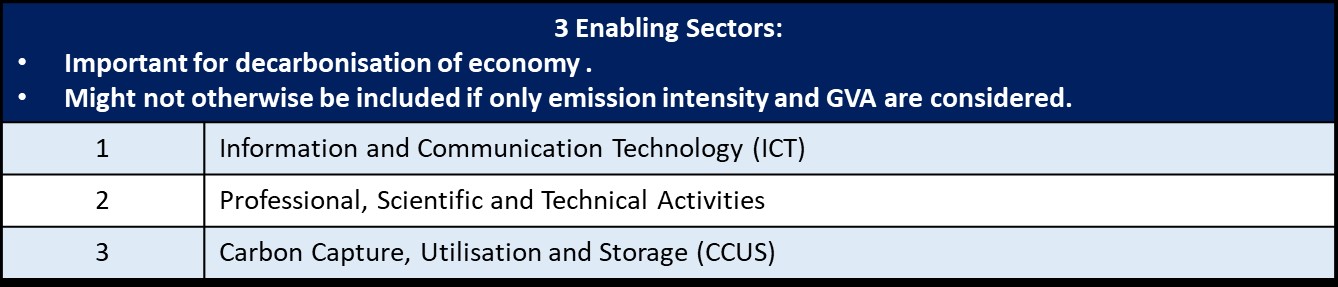

The three enabling sectors below do not themselves risk harm to EOs, but may improve the performance of other sectors and objectives:

Figure 3-2 – Enabling Sectors in the ASEAN Taxonomy

Source: ASEAN Taxonomy Version 1

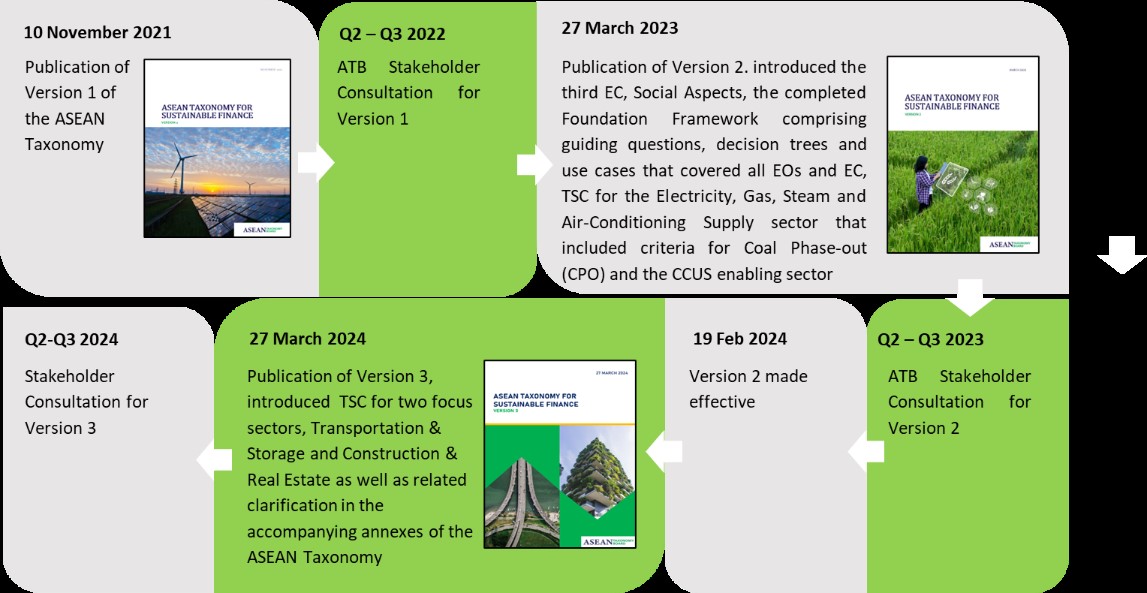

6.0 Significant Milestones of the ASEAN Taxonomy

Version 1 of the ASEAN Taxonomy was issued on 10 November 2021 and contained the conceptual framework and the key components of a sustainable finance taxonomy that is tailored to address the needs of all AMS. After a targeted stakeholder consultation exercise of Version 1, Version 2 of the ASEAN Taxonomy was published on 27 March 2023. Version 2 introduced the third EC, Social Aspects, the completed Foundation Framework comprising guiding questions, decision trees and use cases that covered all EOs and EC as well as the TSC for the Electricity, Gas, Steam and Air-Conditioning Supply focus sector that included criteria for Coal Phase-out (CPO) and the Carbon Capture, Utilisation and Storage enabling sector. Following the release of Version 2, another stakeholder consultation exercise was undertaken by the ATB and with the results strongly supporting Version 2. After incorporating stakeholder input, Version 2 was made effective on 19 February 2024. Concurrent with stakeholder consultation of Version 2, the ATB also developed TSC for two focus sectors, Transportation & Storage and Construction & Real Estate for Version 3. Related clarification in the accompanying annexes of the ASEAN Taxonomy was also included in Version 3, which was published on 27 March 2024. A stakeholder consultation of Version 3 is in the process of completion and development of Version 4 of the ASEAN Taxonomy is targeted to commence in Quarter 4, 2024.

Figure 4 – Significant Milestones of the ASEAN Taxonomy

Source: Sustainable Finance Institute Asia (2022)

7.0 Application and Scope

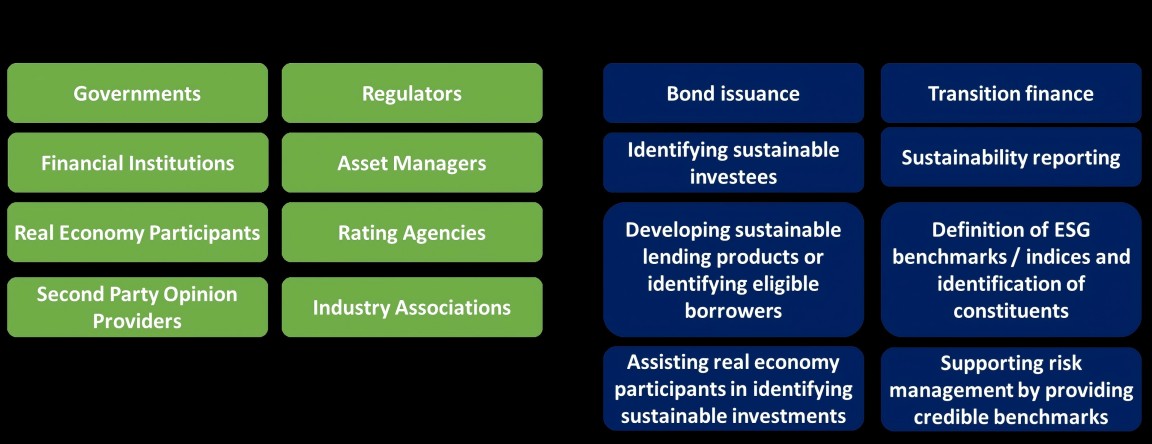

The ASEAN Taxonomy can serve a variety of purposes and be used by different user groups. In addition to providing a common language to investors, financial institutions, policymakers and real economy participants to orientate capital towards sustainable activities, it can help create financial products or an asset class, e.g. a transition asset class. It also assists capital providers in making informed decisions whilst also helping businesses and project owners meet eligibility criteria for sustainable financing. The ASEAN Taxonomy can also potentially minimise the risk of greenwashing in supporting risk management by providing credible benchmarks. The application and scope of the ASEAN Taxonomy is summarised below:

Figure 5 – Broad Users and Uses of the ASEAN Taxonomy

Source: ASEAN Taxonomy Version 2

8.0 Stakeholder Consultation and Market Recognition

The ATB regularly seeks input from stakeholders to obtain critical feedback to understand the needs and expectations of users, particularly on implementation, interoperability and capacity building. Targeted stakeholders of the ASEAN Taxonomy include government ministries and agencies, real economy participants, industry bodies, international organisations including civil society organisations, other taxonomy developers as well as financial institutions. These stakeholders are engaged via online questionnaires, roundtable sessions, small group discussions and direct interviews. Stakeholder feedback has been encouragingly positive, especially in reference to the ASEAN Taxonomy’s multi-tiered approach that caters to the different levels of readiness of AMS and its role in promoting inclusivity. On interoperability, stakeholders welcomed the consideration that, for the Electricity, Gas, Steam and Air-Conditioning Supply focus sector activities, the Green Tier of the ASEAN Taxonomy has been benchmarked to the EU Taxonomy, as well as AMS national taxonomies such as the Thailand Taxonomy Phase 1 and the Singapore-Asia Taxonomy. Stakeholders have also commented that the Amber Tiers of the ASEAN Taxonomy can assist in facilitating transition such that the metrics and thresholds of the Plus Standard may be used as benchmarks for economic activities to develop a company’s transition targets. Various stakeholders have also requested for clarification and additional narrative for terms and definitions set out in the ASEAN Taxonomy and the ATB has taken these requests into consideration in the finalisation process.

The ASEAN Taxonomy has also been referenced in various publications and organisations. It has been regarded as one of three most influential taxonomies in The New Geography of Taxonomies (Natixis, July 2023) and as one of three taxonomies accepted by the Financial Services Regulatory Authority of the Abu Dhabi Global Market (ADGM, July 2023). Additionally, all AMS national taxonomies have also made reference to the ASEAN Taxonomy in the development of its national taxonomies, reinforcing the importance of interoperability and alignment.

Conclusion

The usability of taxonomies depends on several factors including relevance, robustness of its basis and methodology as well as its intended scope and application. The availability of transparent data sets also impacts choice of design. The goal of the ASEAN Taxonomy is such that the principles-based FF may be used immediately by every AMS and business with the ultimate goal of eventually adopting the TSC-based PS.

With the proliferation of taxonomies, an important consideration is which taxonomy should be applied. Naturally, mandatory taxonomies take precedence. If cross-border finance flows involve multiple jurisdictional taxonomies, a project owner needs to consider all capital providers’ needs, policies and internal requirements. Fundamentally, interoperability of taxonomy design between national, regional and international frameworks will minimise confusion. Additionally, taxonomies ultimately need to attain equivalence, where eligibility in one taxonomy is recognised in another. The ATB and AMS have made significant efforts to align key characteristics of the ASEAN Taxonomy and AMS taxonomies such as EOs, EC and the TSC for comparable activities. The TSC of AMS national taxonomies can be mapped against a tier in the PS, reinforcing the intention of the ASEAN Taxonomy to be the taxonomy of equivalence for ASEAN.

References

ACMF. 2020. Roadmap for ASEAN Sustainable Capital Markets.

ADGM. 2023. Supplementary Guidance – Sustainable Finance Regulatory Framework.

ASEANstats. 2024. ASEAN Statistical Brief Volume IV.

ASEAN Taxonomy Board (ATB). 2024. ASEAN Taxonomy for Sustainable Finance Version 3.

Bank Negara Malaysia (BNM). 2021. Climate Change and Principle-Based Taxonomy.

Bank of Thailand (BOT). 2023. Thailand Taxonomy Phase 1.

European Commission. 2020. Taxonomy: Final Report of the Technical Expert Group on Sustainable Finance.

E3G. 2022. Expanding Common Ground: Deepening International Cooperation on Taxonomies.

MDB IDFC. 2015. Common Principles for Climate Mitigation Finance Tracking Version 2.

Monetary Authority of Singapore (MAS). 2023. Singapore-Asia Taxonomy for Sustainable Finance.

Natixis. 2023. The New Geography of Taxonomies.

OJK. 2024. Taksonomi Untuk Keuangan Berkelanjutan Indonesia (Indonesia Taxonomy for Sustainable Finance).

People's Bank of China. 2021. The Green Bond Endorsed Projects Catalogue.

Securities and Exchange Commission. 2024. Guidelines on the Philippine Sustainable Finance Taxonomy.

Securities Commission. 2022. Principles-Based Sustainable and Responsible Investment Taxonomy.

SLC. 2020. Report on The Roles of ASEAN Central Banks in Managing Climate and Environment-related Risks.

WC-CMD. 2020. Report on Promoting Sustainable Finance in ASEAN.

SLC. 2020. Report on The Roles of ASEAN Central Banks in Managing Climate and Environment-related Risks.

WC-CMD. 2020. Report on Promoting Sustainable Finance in ASEAN.