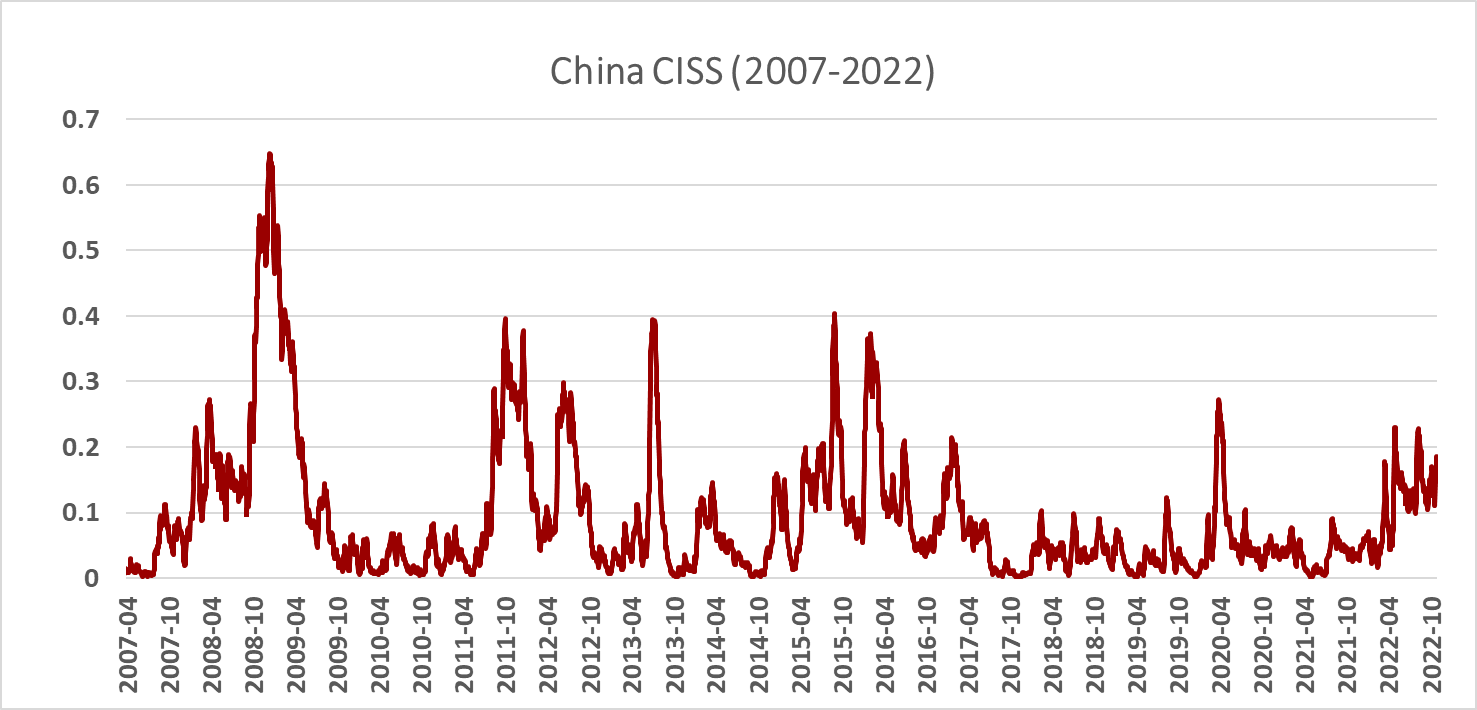

It is critical for financial regulators to assess the overall level of stress in the financial system in a timely manner, but various financial markets often send mixed signals. To address this problem, we present a single composite indicator of financial stress(China CISS) based on 13 financial indicators of the equity market, the bond market, financial institutions and the foreign exchange market.

To capture the stylized fact that co-movements between markets are much stronger during times of financial stress, we use the time-varying correlation matrix between sub-indices as a dynamic weighting mechanism, and identify the episodes when both the covariance and co-extremeness across markets are jointly high as “systemic” stress events. We conduct multiple robustness checks and find that the China CISS is a markedly robust statistic in the time dimension.

The China CISS is jointly developed by the MGF Lab and the ECB. The China CISS is daily updated, with values between (0,1). Higher values indicate higher systemic financial risk.

In mid-to-late October 2022, China's systemic financial risk gradually increased, with the latest figure of 0.186 on October 28.

Note: the original data can be downloaded in ECB Statistical Data Warehouse.

For the original paper, please see the Attachment. Only Chinese version available.